פארמערס לויבן או פרעזידענט טראמפ'ס ארבעט פאר זיי

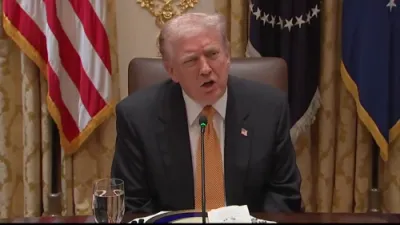

During a White House agriculture roundtable, an Iowa farmer expressed gratitude to President Trump, telling him, “I’ll be able to potentially pass over my farm to my children, because of you.” The exchange highlights the tangible impact of the 2017 Tax Cuts and Jobs Act on American family farms, particularly in reducing estate tax burdens that previously threatened generational transfers of property.

The tax reforms doubled the estate tax exemption to $11.18 million, providing critical relief for an estimated 2 million U.S. family farms, according to USDA data. For decades, farmers faced the challenge of paying substantial taxes upon inheritance, often forcing the sale of land to cover liabilities. Trump’s policy adjustments, supporters argue, preserve rural heritage, secure livelihoods, and empower farmers to maintain generational continuity without sacrificing their property to federal taxation.

As the current estate tax exemptions face potential expiration at the end of the year without congressional renewal, the farmer’s remarks underscore the significance of Trump-era policies on the agricultural community. By safeguarding family farms, the administration not only supports economic stability in rural America but also strengthens the social and cultural fabric of the nation’s heartland.