דעיוו רעמעזי צונעמט די ביג ביוטעפול ביל וואס איז נוגע

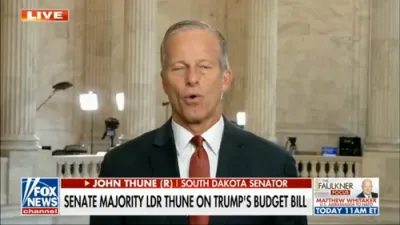

Financial expert Dave Ramsey recently broke down what’s being referred to as “Trump’s Big Beautiful Bill,” a sweeping tax reform initiative that's once again making headlines. Ramsey, known for his no-nonsense approach to personal finance, highlighted the key elements of the bill and what it means for everyday Americans.

What Is the Big Beautiful Bill?

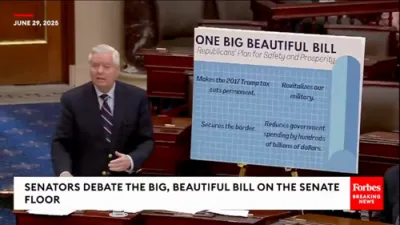

Originally introduced during President Trump's first term and now being revived in his current administration, the “Big Beautiful Bill” is designed to cut taxes, simplify the tax code, and encourage economic growth. Supporters say it gives relief to middle-class families and boosts job creation by reducing burdens on businesses.

Key Highlights According to Dave Ramsey

Tax Cuts

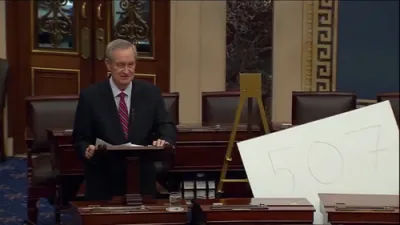

At the heart of the bill are major income tax reductions:

- Lowered rates for individuals and families

- Higher standard deductions

- Reduced corporate tax rate, aimed at keeping jobs and capital in the U.S.

Ramsey emphasized that lower taxes can help families pay down debt and save more, provided they manage their finances wisely.

Tax Deductions

The bill also expands certain deductions:

- Child Tax Credit enhancements

- Increased limits on retirement contributions

- Higher thresholds for itemized deductions on things like medical expenses and mortgage interest

“This is a great time to reassess your tax strategy,” Ramsey advised. “The deductions are broader and easier to use, especially for middle-income households.”

Miscellaneous Provisions

Several other components of the bill could affect small business owners and individual taxpayers:

- Simplified tax brackets and fewer loopholes

- Incentives for investing in U.S.-based businesses

- Repeal of some lesser-known taxes that previously impacted high earners

Ramsey’s Bottom Line

While praising the bill’s pro-growth design, Ramsey reminded viewers that “a tax cut won’t fix bad spending habits.” He urges individuals to use the extra cash wisely—pay down debt, build an emergency fund, and invest for the future.