אמעריקאנער הייזער חובות האט דערגרייכט איבער 18 טריליאן דאלער!

WASHINGTON, D.C. — American households are facing a new financial milestone — and not a positive one. According to new data from the Federal Reserve Bank of New York, total U.S. household debt has reached a record-breaking $18.59 trillion in the third quarter of 2025, rising by $197 billion in just three months.

The report reveals that debt across nearly every major category is climbing. Mortgages continue to make up the largest share, totaling $13.07 trillion, followed by auto loans at $1.66 trillion. Credit card balances also hit new highs, with the average American carrying $6,523 in revolving debt at an average interest rate of around 20%. Student loans, though stabilizing somewhat, remain a major financial burden for millions.

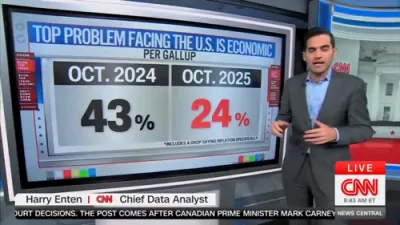

Economists point to persistent inflation and higher living costs as key drivers of the surge. Even as wages grow modestly, consumers are relying more heavily on credit to cover everyday expenses, from groceries to gas. The result: a widening gap between income and debt obligations, leaving many families walking a financial tightrope.

Perhaps most concerning are the signs of distress beneath the surface. The New York Fed’s data show delinquency rates rising notably among credit card and auto loan borrowers, suggesting growing difficulty in meeting payments. Despite steady job growth and overall economic resilience, many households appear to be stretched to their limits.

Analysts warn that the trend could worsen if interest rates remain elevated or if the labor market weakens. The combination of record borrowing and rising delinquencies may place additional pressure on both lenders and consumers heading into 2026.

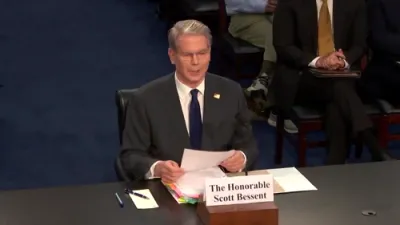

While the Biden-era spending legacy and ongoing inflation have shaped much of the current economic landscape, the Trump Administration faces the challenge of stabilizing household finances while maintaining economic momentum. The record-breaking debt figure underscores the urgent need for policies that encourage savings, curb inflation, and restore long-term financial stability for American families.