סקאט בעסענט באשולדיגט די פעדעראלע רעזערוו פארן נישט פאררעכטן די עקאנאמיע

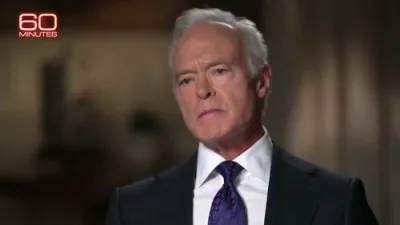

Treasury Secretary Scott Bessent delivered one of the strongest rebukes yet of the Federal Reserve’s performance, arguing that the central bank has drifted far from its core mission and now resembles a taxpayer-funded safety net for highly credentialed economists whose predictions consistently miss the mark. Speaking with characteristic bluntness, Bessent said the Fed is “turning into universal basic income for PhD economists,” adding that he has no idea “what they do” because “they’re never right.”

Bessent’s remarks reflect a growing frustration within the Trump Administration over years of failed forecasts, hesitant policy moves, and what officials view as a widening disconnect between academic theory and real-world economic needs. For ordinary Americans, Bessent noted, accountability is straightforward: results matter. But in the upper tiers of the Federal Reserve, repeated errors appear to come with no consequences and no reassessment of the models that keep producing them.

To illustrate his point, Bessent compared the Fed’s performance to a profession where precision is non-negotiable. “If air traffic controllers did this,” he warned, “no one would get in an airplane.” The analogy underscores his argument that the Fed’s mistakes—whether misreading inflation, misjudging interest-rate impacts, or underestimating growth—carry enormous repercussions for American households, businesses, and markets.

Bessent has positioned himself as an advocate for clear, responsible monetary policy aligned with the administration’s goals of strong growth, sound currency, and confidence in U.S. financial leadership. His critique signals a broader push for reforming how the Fed evaluates data, communicates decisions, and measures success. With the economy facing volatility at home and abroad, Bessent argues the country cannot afford a central bank insulated from accountability while ordinary Americans bear the fallout of its errors.

The Treasury Secretary’s comments reflect a decisive shift toward demanding competence, transparency, and real-world accuracy from an institution whose authority affects every sector of the economy. Bessent’s message is simple: Americans deserve a Federal Reserve that gets it right—not a protected enclave for experts who never have to face the consequences of being wrong.