זאהארן מאמדאני לייגט ארויף פרישע פראפערטי טעקס

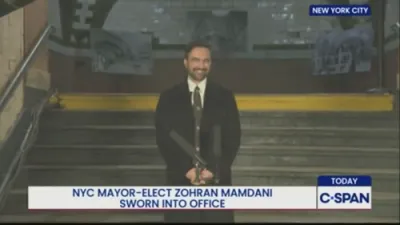

New York City Mayor Zohran Mamdani is confronting a $5.4 billion budget shortfall with a stark warning that the city faces only two viable paths to meet its legal obligation to balance the books. Speaking on the city’s $127 billion fiscal year 2027 budget, Mamdani framed the choice as one between structural reform through higher taxes on high earners and large corporations at the state level, or a series of painful local measures that would directly impact property owners and draw down financial reserves.

The mayor is urging Albany to approve a 2 percent increase in personal income taxes on roughly 33,000 New Yorkers earning more than $1 million annually, along with higher corporate taxes on the most profitable firms. He argues that New York City generates 54.5 percent of state revenue while receiving only 40.5 percent in return, a disparity he says has worsened as the city’s share of statewide GDP has grown by nearly 10 percent since 2010. In his view, correcting this imbalance is essential to achieving long-term fiscal stability without shifting the burden onto middle- and working-class residents.

Absent state action, Mamdani says the city will be forced to rely on what he describes as a “last resort” strategy. That plan would include a significant property tax increase—estimated at approximately 9.5 percent—and withdrawals from key reserve funds, including nearly $1 billion from the Rainy Day Fund in fiscal year 2026 and additional funds from the Retiree Health Benefit Trust in 2027. Such steps, he noted, have historically been used only during extraordinary crises, including the 2008 financial collapse and the pandemic-driven revenue shock.

The mayor emphasized that New York City has no legal option to run a deficit, a requirement imposed after the fiscal crisis of the 1970s that brought the city to the brink of bankruptcy. That statutory mandate removes the possibility of deferring hard choices, forcing policymakers to identify either new revenue sources or spending adjustments within a fixed timeframe.

While the state has already provided approximately $1.5 billion in aid, that support covers only a portion of the projected gap. Mamdani’s proposal has triggered debate among business groups, fiscal watchdogs, and residents, with critics arguing that additional taxes could accelerate outmigration of high-income taxpayers and corporations, potentially eroding the city’s tax base. Others contend that reliance on property tax increases would disproportionately affect homeowners and renters, given the way those costs are passed through the housing market.

The administration maintains that targeting top earners and highly profitable corporations is the least disruptive option for the broader population, particularly at a time when median household income stands at about $122,000. The mayor has positioned the request to Albany not only as a budget solution but as a recalibration of the fiscal relationship between the city and the state.

As negotiations continue, the outcome will determine whether New York City can close its budget gap through external revenue changes or must implement internal measures with immediate economic consequences. The decision carries implications for housing costs, municipal services, long-term fiscal resilience, and the city’s competitive position in attracting and retaining businesses and high-income residents. With the legal deadline to adopt a balanced budget approaching, the pressure on both City Hall and Albany to reach a resolution is intensifying.