פעד האלט די ראטעס שטאנד בשעת טראמפ'ס אליאירטע דריקן אויף א רעיט שניט.

The Federal Reserve concluded its January 28, 2026 meeting by holding interest rates steady, opting against further cuts despite mounting political and internal pressure. The decision keeps the federal funds rate locked in the 3.5 to 3.75 percent range, marking the first pause in rate reductions since July 2025 after three consecutive cuts aimed at easing inflationary pressures.

Federal Reserve Chair Jerome Powell and the majority of the Board voted to maintain the current rate level, signaling a cautious approach as inflation continues to cool and economic indicators remain mixed. However, the decision exposed clear divisions within the central bank, as two Trump-appointed governors broke ranks and voted for an immediate 25-basis-point cut.

Governors Stephen I. Miran and Christopher Waller issued firm dissents, arguing that economic conditions now justify faster and more decisive easing. Their votes reflect a growing push within the Fed to support stronger growth, protect labor markets, and prevent unnecessary economic slowdown as inflation pressures ease.

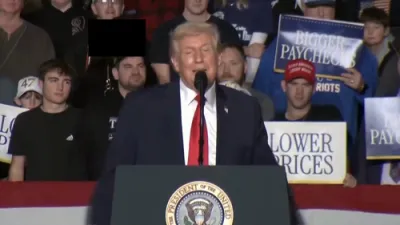

The split decision comes amid sustained public calls from President Donald Trump for more aggressive monetary easing. The president has repeatedly argued that lower interest rates are essential to accelerating economic expansion, supporting American workers, and strengthening U.S. competitiveness. The dissents by Trump-appointed governors underscore alignment with that broader growth-focused agenda.

By choosing to hold rates steady, the Federal Reserve signaled that it remains wary of moving too quickly, even as inflation shows signs of stabilizing. The pause highlights the delicate balancing act facing policymakers as they weigh economic momentum against long-term price stability. With divisions now clearly visible within the Fed, future meetings are likely to draw increased scrutiny as pressure builds for rate cuts aimed at sustaining growth.